A Map Against Marginal Thinking

Discovering value by stepping away from the media spotlight

Originally published on: https://www.thinkvalue.co/analysis/map-against-marginal-thinking

In this article, we will discuss how the spotlight focuses our attention on things that are harder to benefit from.

We can call this drive to focus on the spotlight: “Marginal Thinking”.

Key Takeaways

What is popular is rarely useful, and you can’t always be lucky. When we focus our attention on the next thing, we may be playing someone else’s game.

Most of the content is meant to drive a narrative or clicks - and inflammatory content tends to sell.

Companies surrounded by hype may not be a great investment, but it’s easier to be around like-minded people and defer to authority.

Having a method, fixes a small part of this. Which is why I propose using a map to avoid companies that are under the media spotlight.

In the previous part1, I discussed what it means to stray from the herd: Understanding core concepts well enough to be able to discriminate quality from pretence - “labelism”.

The Media is Everywhere

Eric Weinstein talked about the asymmetry of power between companies (media) and the individual.

In short, imagine that there is a big machine pointed at the individual. This machine tracks, and shares information with other machines, so there is no hiding.

This is used to profile you by comparing your psychographic characteristics to the millions of other people. Finally, it uses this information to iterate the content you are most likely to react to, and it gets good.

This is crucial, it's so good that people start adopting its served opinions that were a result of a months-long campaign. Yet, when we hear it for people, we tend to associate these opinions with authenticity.

They’re not authentic.

They are the result of an info feed that iterates until it reaches critical mass to become its own cultural moment.

Let’s explore how this affects investing.

Marginal Thinking

Marginal thinking was first described by the Austrian economists, who showed that value is relative to our current wants, as opposed to the costs of production.

This means that value follows from our wants, and taking it one step further, our wants follow from the current focus of our attention.

For investments, we can see this in something called the (ERP) equity risk premium of the marginal investor. While forecasts can be prone to error, the ERP is the truly subjective (not for us) part of investing. Most of the time it matters very little, unless it touches extremes - which are moments of panic or mania of market participants.

We won't go into the mechanics of ERP here, but you can find a short description in a previous piece2.

When the media cycle takes on a topic, our attention moves to that story, regardless of a stock's potential. We find ourselves in an amplified state of “fear of missing out” or “fear of losing money”, and may end up making a worse decision than we would.

In a nutshell, this amplification crowds the market and can make us buy higher and sell lower.

This means that it may be better to stay away from the crowd even if our predictions are right - unless we are early in the cycle.

This is why a method for discovery is important.

Approach From the Ground-Up: Use a Map

A map can help us identify where the current attention is, and help us move away from it.

So, if AI is the new rage, we may look at tourism companies; if TSLA 0.00%↑ is the highlight of the week, we may look into a peer like RACE 0.00%↑ instead.

We still expect to find a reason why a company was overlooked, but hope that it's no longer valid.

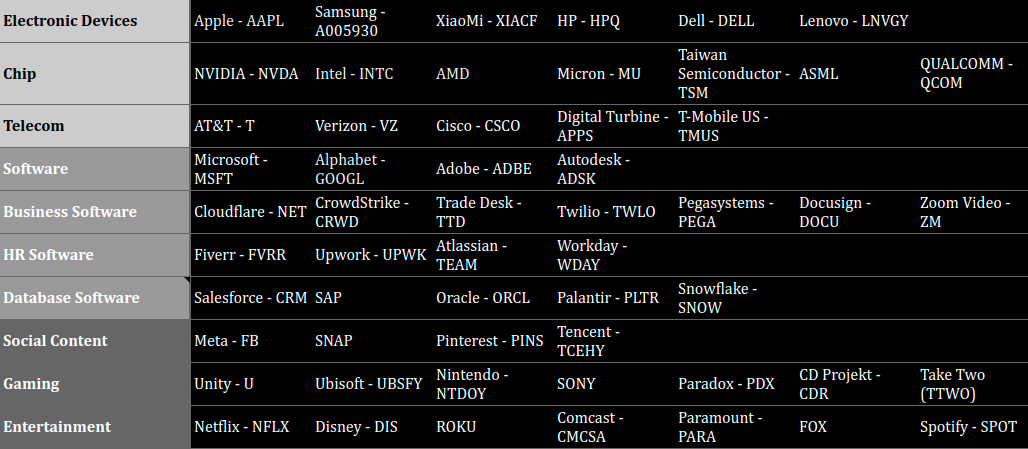

I’ve constructed my own map, and use it when I’m interested in seeking exposure to a certain industry:

You can view the full map in my spreadsheet.

Further, when we analyze our next company, we may opt to be uncomfortable, and read content only after we have valued a company ourselves. This discomfort of “getting it badly wrong”, will help us think about the driving fundamentals of a company instead of attaching numbers to a story we want to believe in.

In conclusion, we will revisit a cliché phrase,

If you read about it, it’s priced-in

We need to be bold enough to search on our own, and exploit the mistakes of authority figures.