The Inflation Hedge from PepsiCo, Inc. is Overbought

Why the company's valuation relies on the assumption that inflation eventually goes down.

While most of the stock market entered into a bear territory in 2022, a subset, consumer goods and retail, kept and even increased their market cap. This has been true for PEP 0.00%↑ as the company is still gaining market cap after its earnings report, and is now trading for close to $236 billion.

Let’s put that into perspective.

It seems a bit excessive that a mature company is trading at a 33x PE ratio, and when conducting a full DCF model for the company it becomes even harder to justify.

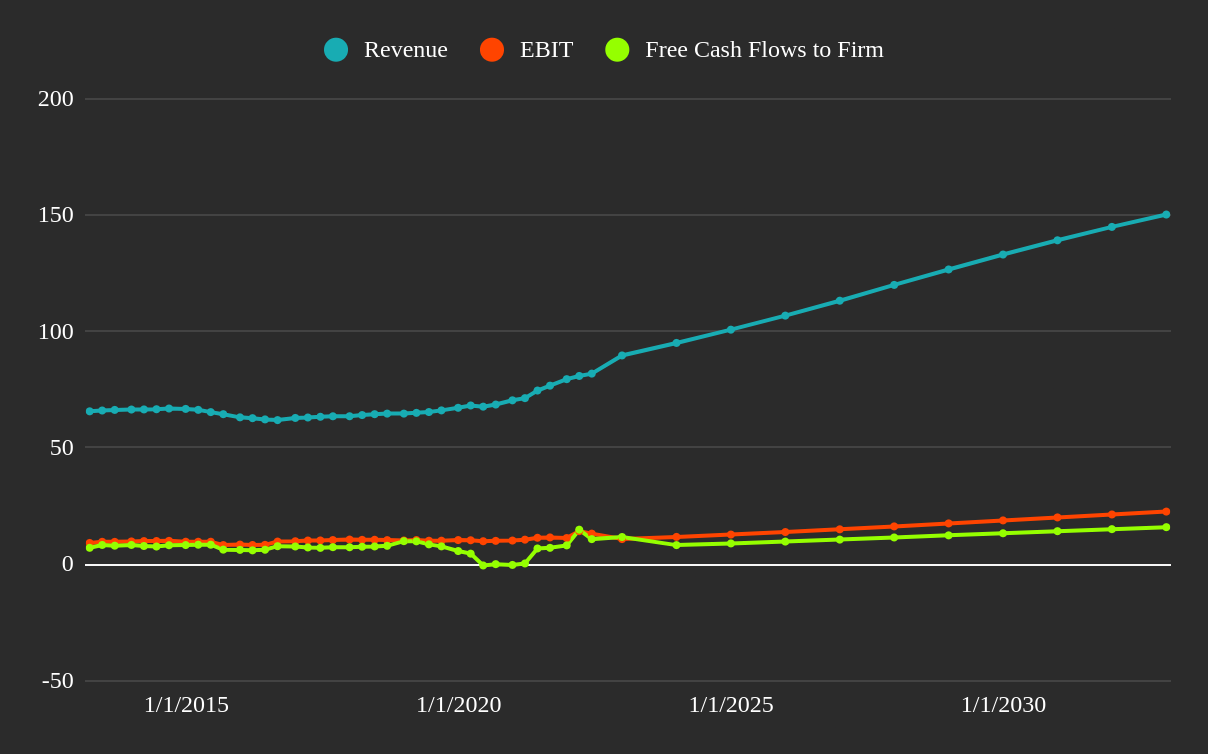

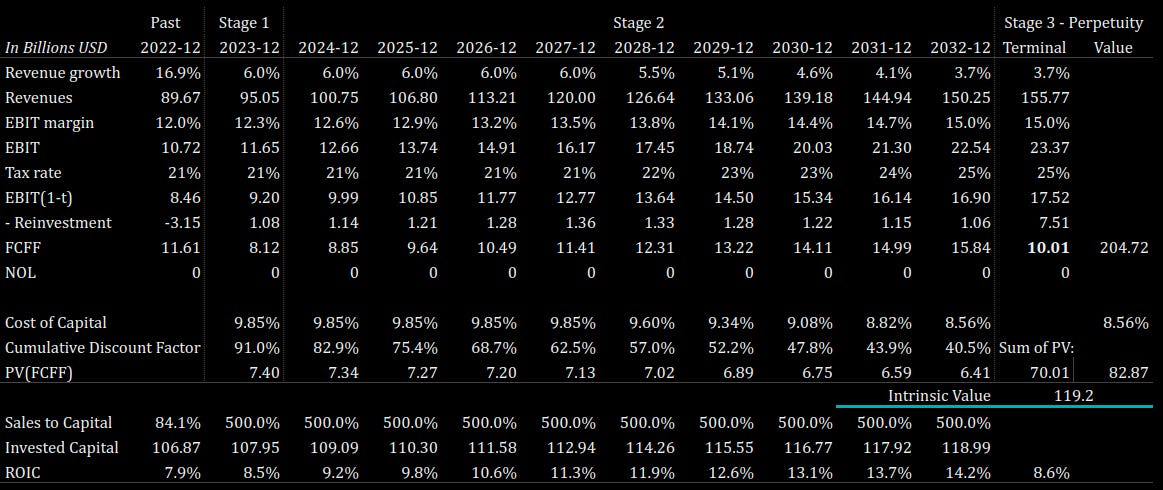

Here is a generally optimistic forecast model for PepsiCo:

This implies a revenue growth of 6% in the next 5 years, then converging to 3.5%. An improvement in operating margins to 15%, and efficient cash flow conversion, close the operating profits.

Note the projections below:

The result is a company that makes $150 billion in revenue, $22.5 billion in operating profit, and close to $16 billion in free cash flows to the firm.

Even with these estimates, the intrinsic value of the company comes out to about $120 billion.

You will notice that the large sales to capital implies minor reinvestment in the company, which is consistent with the inflation backed revenue growth rate of 6%.

It seems that the company was close to fairly valued around 2020. However, as inflation kicked-in, PepsiCo slowly started losing value while posting top line growth. This value degradation comes from the increased cost of capital from around 6% to around 10% today.

Conclusion

Investors have flocked to PEP 0.00%↑ and similar consumer goods & retail companies in an effort to offset inflation. While this has worked with revenues, the market is now demanding higher returns from companies.

This can turn into a negative catalyst investors accept that rates are not coming down soon, and the market factors-in the increased cost of capital. On the other hand, the market may be (and usually is) right, and we can see a drop in rates which would justify current valuations.

You can copy and tweak the model from the link.