Tesla's (NASDAQ:TSLA) Intrinsic Value - Not as Bearish as Some Would Hope

Why I valued Tesla (NASDAQ:TSLA) at $250 billion or $240 per share

I valued Tesla (NASDAQ:TSLA) at $250 billion or $240 per share. An estimated 220% downside.

Before you get to the article, I want to say that I’m still learning, and likely very wrong on most estimates, so feel free to give me your version and I will tweak the valuation for you!

Summary

This is a general valuation, and is not meant to be precise, rather it is intended to give people a good grasp of the value of Tesla’s cash generating capacity. We can also apply a 12-month price target, which comes out at $260 per share.

I do try to make a balanced valuation on Tesla, however when we open the model, we will see that I am very optimistic on the future profitability of the company, which has not been the historical case with car manufacturers.

Valuation result:

We can see that the shares have a 220% downside, which puts this company is a high risk category, and will likely require a lot of discipline and patience from investors.

What Does Today’s Price Mean for Tesla?

Alternatively, we can flip the valuation, and ask “How long would Tesla need to perform in order to justify the current price?”

By substituting forward years with our base, we find that investors are about 3 years early on the value of TSLA. This is a very risky experiment, as I am holding constant the growth rates, substituting the projected revenues and EBIT in year 3, as my base year. Implicitly, we are saying that growth continues - which is hard to justify, and that the company has the same risk factors three years from now - which is also hard to predict, as technologies change, competitors advance and the market also changes.

The key insight is that just a few weeks ago, the market was willing to value Tesla based on future performance of more than 3 years, which is why we got valuations of $1 Trillion plus. Now that the risk landscape is changing, we see investors switching their valuation from the potential future performance to a model that is closer to the present.

Should investors decide to value the company based on the intrisic value today, we could see the price converge to around $240 per share.

Next, I will present the model parameters, and HOW I got the current valuation.

Valuation Model Parameters

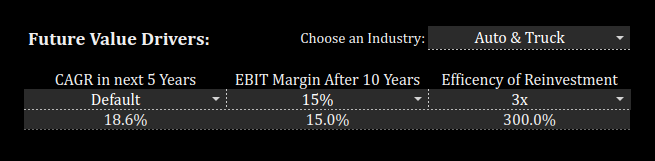

I am using a 2 stage DCF model to value the future cash flows to all investors (FCFF). Every model needs assumptions, and here are mine:

The final result is a valuation model that looks roughly like this:

Side Note: The chart above, shows how Tesla needs to perform in order for it to have an intrinsiv value of $240 per share. The current $600ish price level assumes much better performance than what you see in the cart above.

Growth

I assume that Tesla grows revenue close to 20% on average in the next 5 years, after that the company will approach maturity and the revenue growth rate will converge to the riskfree (inflation) rate. This gives the company $230b in year ten, which is roughly in-line with mature auto manufacturers like Volkswagen (TTM USD 269b) and Toyota (TTM USD 247b).

One of the rare ways in which Tesla can surpass this growth is to diversify horizontally and expand into trucking and other transportation vehicles. The company is currently setting the groundwork for semi-trucks, but it is too early and this is too ambitious to include it in today’s valuation.

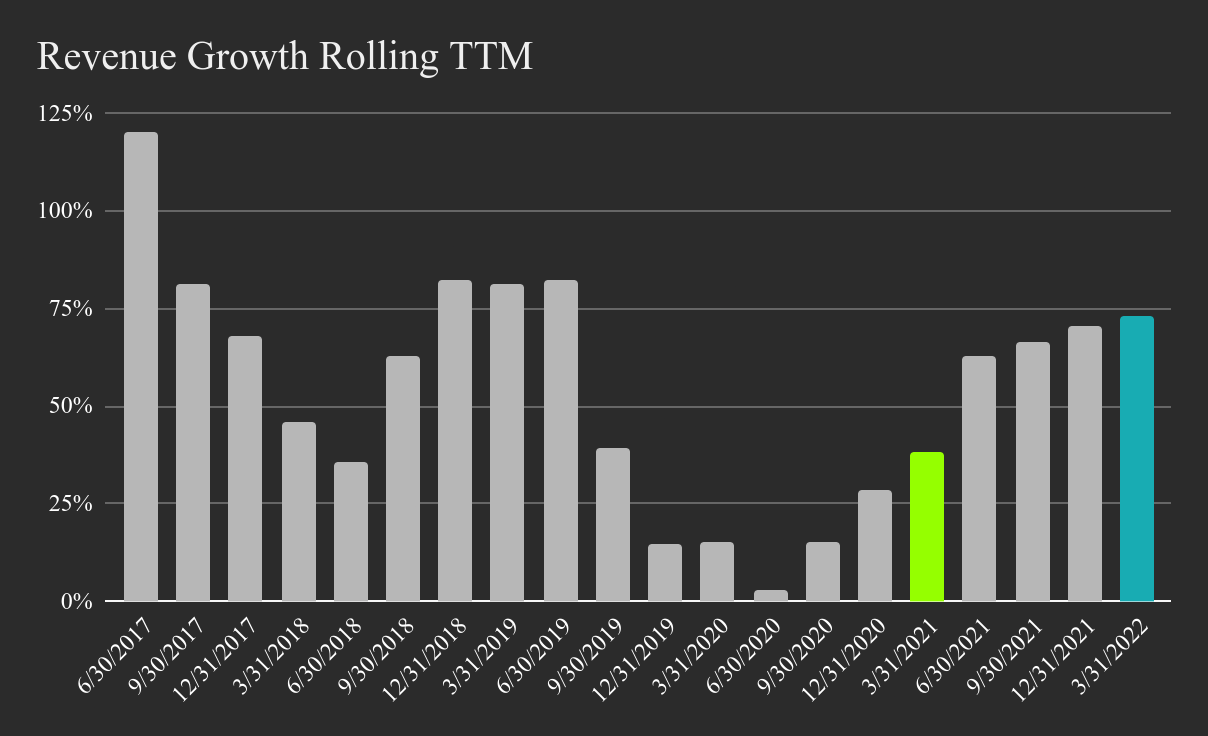

I base my growth assumption on historical performance, where the company is in the lifecycle and some industry patterns.

Here is how the company performed thus far:

As you can see, historical rates are much higher than my estimated 18.6% growth rates. This is because attaining high growth rates becomes harder as a company matures. Additionally, competitors are also expanding in the EV market, and won’t just roll over for Tesla to take the market share.

Nonetheless, I do position Tesla as a market leader and grow their revenues to the size of top producers.

Some details on growth:

These are a range of calculations that help me decide on a growth rate, and you can view them HERE.

There are two things to note, one is that the Growth vs COGS scaling is positive. This is important and has implications for profitability. Tesla has profitability efficiencies built into the business. This comes from their gigafactory approach, which can create excess value based on the sheer size of output.

If Musk and his engineers are right with this approach, they will continue to be the most valuable auto manufacturer, since they can squeeze more profit from production vs traditional manufacturers that have a network of smaller plants.

Vehicle Market

While the company will grow substantially, it is important to note that it is positioned in a cyclical market. The auto and truck sales follow economic expansions, but also shrink in economic downturns.

Here, we can see this is the US Vehicle sales over the years:

Note, that the max level of auto and light truck (SUV's) sales in the US is about 17.5m per year, this means that Tesla must operate and be successful internationally in order to justify the valuation model.

A Key Risk Factor for Growth

While there are multiple risk factors for the future, a major one is the slow merger between auto transportation and shared mobility.

This means that the world is moving to become more mobile by ride-sharing and similar approaches, which connect passengers to a destination more efficiently.

For auto manufacturers, this means that they will wake up in a declining market, and the possible revenue will start shrinking. The mobility approach will likely decrease the need for a second family car, and will also make vehicle renting a more viable approach for people.

Moving on, to the next value driver - Profitability.

Tesla’s Estimated Profitability

In order to make a model work for investors, besides growth a company must generate profit.

Even though Tesla is not making too much money today, we need to make our best guess as to how much money the company will be making in the future.

For Tesla, I estimate that the company will converge to a 15% operating (EBIT) margin, in the next 10 years.

This is significantly higher than both US and Global auto manufacturers average margins of 5.9% and 6.1% respectively.

The reason I believe Tesla will be able to sustain 15% EBIT margins is because of the mentioned scaling efficiencies, as well as the excess returns coming from their proprietary self-driving software. While this software has issues at the moment, I see the engineers improving upon these systems and unlocking new use cases that will make the company more valuable in the future.

Looking at the historical performance, here is how Tesla is doing on the profitability front:

While the company is currently making 15.3% EBIT margins, it may not be able to grow much more in the long term, and may converge back to these levels.

Margins are something I could be widely miscalculating, but I do not see them being higher than 20% and lower than 10% when the company reaches maturity.

In the 10% margin scenario, the stock is valued at $176b ($170 per share).

In the 20% margin scenario, the stock is valued at $319b ($307 per share).

Reinvestment Rate

In order for a company to grow, it needs to reinvest. These reinvestments into the business are subtracted from the profitability (EBIT) to get to our estimated free cash flows (FCFF).

When deciding on a reinvestment rate, we are basically saying “How well a business is set up, and how smart is management in deploying capital?”.

We can get a hint to this parameter when looking at historical returns versus the total invested capital.

For Tesla, here is how their returns fared:

First, we can see that Tesla provides substantially higher returns - both ROE and ROIC than the auto industry. They are even making more than their cost of capital, which makes the company increase in value as it grows the cash flows.

Note: if you remember, in the summary we experimented with growing the intrinsic value as we moved forward in years - this is how that growth in value is justified, otherwise the value would only grow by the discount rate: 8% per year.

Just for reference, we calculate that the average excess return for TSLA is 27% over the cost of capital.

I estimate the reinvestment rate based on: the current sales to capital ratio, where the company is in its maturity, and what is the industry standard for a sales to capital ratio.

A sales to capital ratio is simply the % of annual revenue the company makes, vs the total amount of invested capital in the business. A higher ratio means that the company is more effective at generating revenue with less capital - which is great for investors.

Tesla currently has a sales to capital ratio of 255%, down from the end of 2019 where the ratio was around 500%. The industry standard is about 74%, which makes Tesla a high performer vs the industry.

I decided on a reinvestment rate of 300% because I think the company will continue generating high revenues, but will scale down on investing in new gigafactories after they have reached their target production capacity. In the future, I still see Tesla investing vigorously, but a good portion of those investments will be in engineering talent and software.

Conclusion

All the mentioned assumptions and reasoning above, yield an intrinsic value of $247b or $238.7 per share for Tesla.

Tesla’s current price is widely divergent from the valuation, as investors are implicitly looking at the long term potential of the company - this is a risky approach, because estimating the future is fairly hard and paying a future premium on the value may not be the best approach.

In 2021 the stock also traded in a low interest rate environment while funds has large access to capital. This is no longer the case, and the new discount rates (risk values) may bring the market valuation of the company from paying a premium for 3 years into the future, closer to today.

I am likely wrong on most parameters, but the goal of this analysis was to give investors a general sense of the value of the company, and to see waht needs to be true in order for the current price to be justified.

I hope you found this useful, and here is the full model below: