Sony: A Premium Stock Minimizing Tariff Risk Via Product Diversification

Diversified product portfolio between physical consumer products, gaming consoles + software, and a rising media business with two secular growth avenues: sensors and anime streaming

I estimate the tariff exposure to the U.S. at $10B due to having a diversified portfolio of physical and digital products.

Estimated impact of tariffs to $1.2B on the operating income for FY '26, with a subsequent recovery to growth and margins.

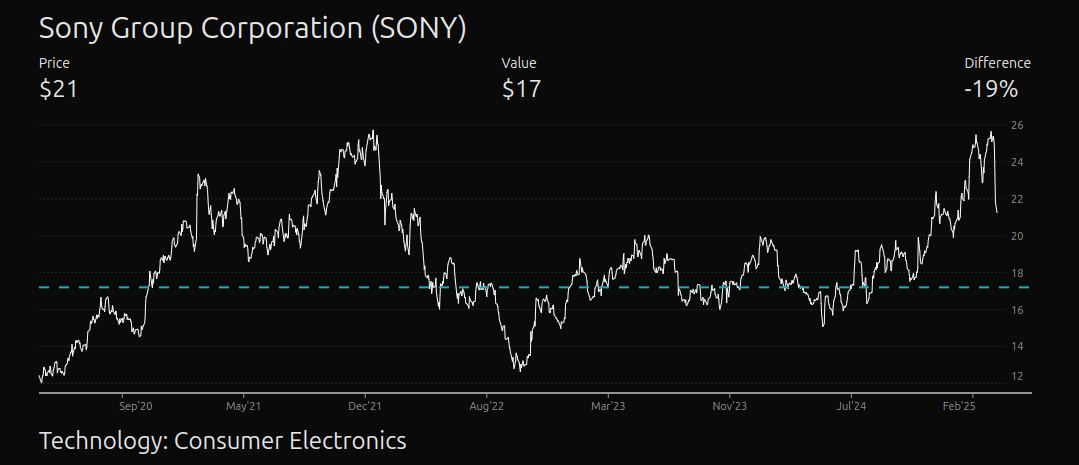

The intrinsic value of $105B or $17 per share indicates fundamental downside, but I expect the company to close the gap within 3 years.

Crunchyroll is a secular growth segment with >15M subscribers that is gearing up to be the 'Netflix of anime streaming and production.'

Despite the current premium pricing, I expect Sony SONY 0.00%↑ to be able to converge the fundamentals to intrinsic value within 3 years. My intrinsic value, which factors-in new tariff impacts is $105B or $17 per share, but I am comfortable rating Sony a “buy” for investors that are prepared to dollar cost average future volatility and have an investment horizon of at least 3 years.

Note: Analyzed this one in tariff confusion, but wouldn't be too quick to write-off the potential impacts.