Lam Research Corporation (LRCX) Analysis

Clear Fundamentals and Trading Around an Intrinsic Value of $60B

Our fundamental analysis indicates that Lam Research Corporation (LRCX 0.00%↑) is trading around intrinsic value with modest growth and profitability assumptions.

We valued the company at $60B with a 1-Year price target at $508 per share.

The continued growth of the company indicates value creation, and we estimate that it will converge on $530 per share at maturity, after which Lam can focus on returning capital to investors.

You can view and tweak the full model by clicking on the button below:

Overview

Lam’s products and services enable chipmakers to develop and produce powerful and cost-effective semiconductor solutions to the marketplace.

The company’s products include plasma etch and deposition systems, thermal processing systems, chemical mechanical polishing systems, photoresist processing systems, and wafer cleaning systems.

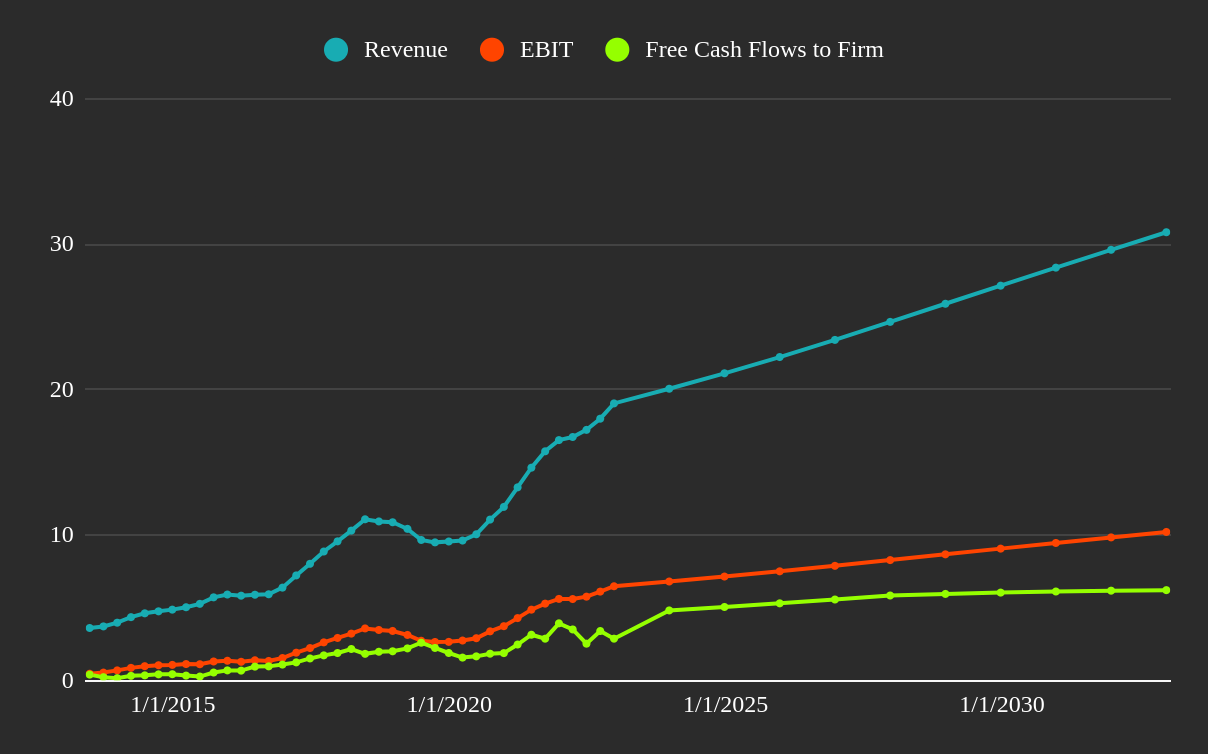

Valuation Model

In the model, we estimate a slowing 5.3% growth rate, below the industry’s 5Y CAGR of 15.7%. This is derived from the fundamental growth rate, which compares the past translation of CapEx into growth.

EBIT margins seem to be holding up on the upper end in the last 5 years, so I assume that the company manages to keep current levels around 33%. Using these estimates, we get the following future model:

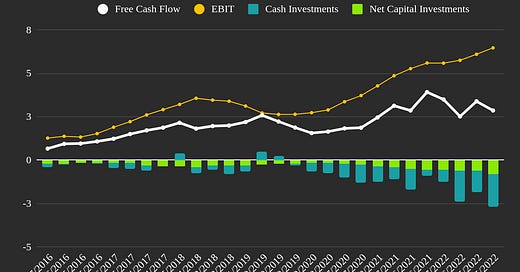

Free Cash Flows

One of the better aspects of LRCX 0.00%↑ are their positive free cash flows to the firm. Indeed the company has managed to stay consistently profitable and cash flow positive, with most of the variation being accounted by capital expenditures:

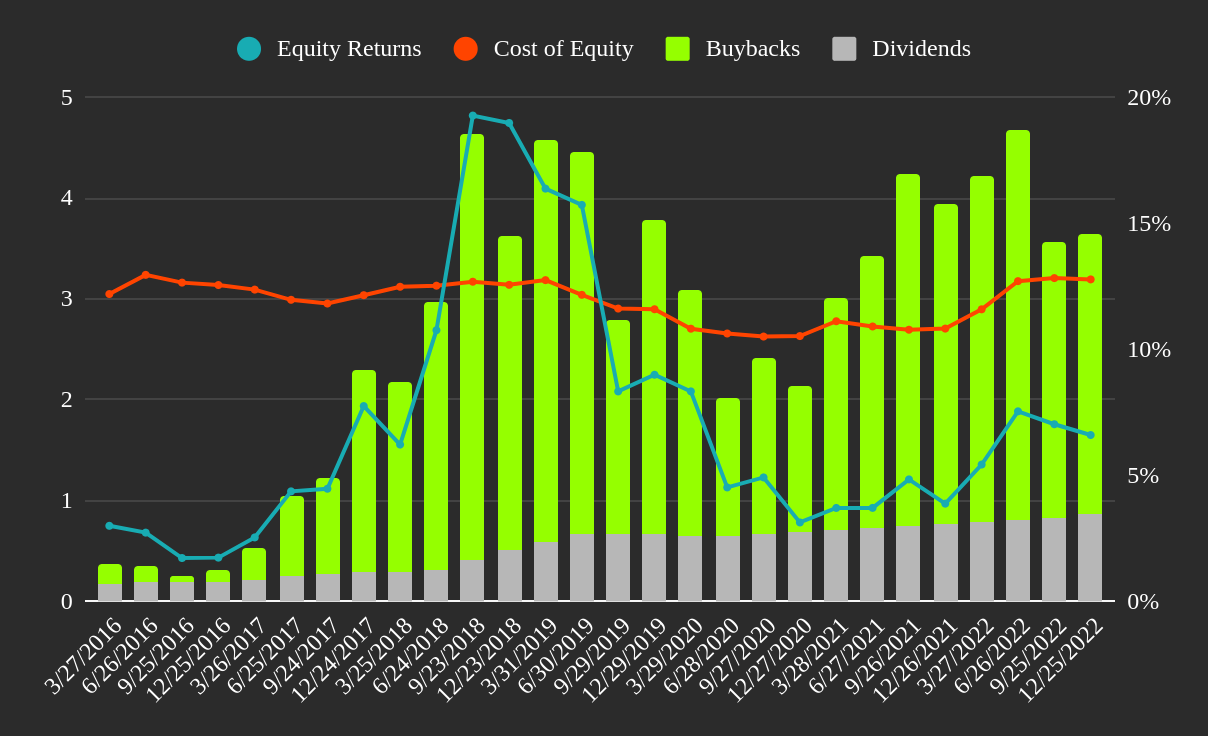

Returns to Investors

Finally, we can see that the company returns capital to shareholders in a mix of dividends and buybacks. The larger portion is returned via buybacks which gives the company flexibility and makes it safer in a negative environment:

Risks

The biggest risk factor to Lam is its exposure to the Asian geopoltical climate which may drive price changes. Some of Lam’s biggest clients are also exposed to the same risks, which can induce a contagion in risk should politics escalate.

Conclusion

Lam is a good example of a stable, disciplined, and fairly valued company. It also has a history or returning capital to investors, which indicates that they can expect appreciation in both price per share and a dividend income.