HubSpot: Fundamentals Are Behind Its Valuation

I expect HUBS to re-rate to 5x EV/Revenue in the next 3 years, with my sales projections at $3.7B, leading to my EV estimate of $18.5B.

Despite my "hold" rating, the company has downside protection to the extent that it can become part of larger competitors to CRM.

Investors that are long HUBS, likely carry with them the assumption that the SMB economy rejuvenates, which would accelerate top-line growth.

NRR is stagnating, and HUBS may have fewer levers to pull for driving growth. The product bundle may be somewhat overpriced and smaller peers may move in to offer competitive pricing.

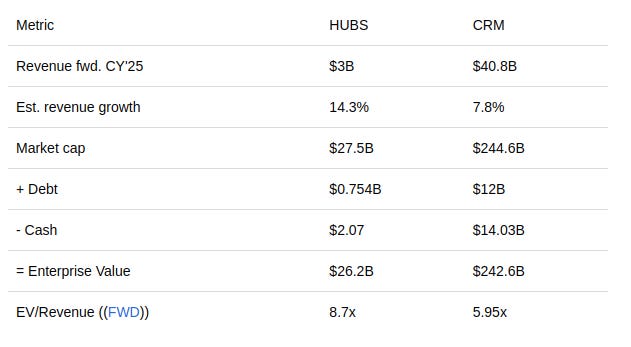

Despite strong revenue growth in the past, I expect HubSpot (NYSE:HUBS) to experience a stagnation in growth and be challenged by the market leader in customer relationship management—Salesforce (CRM), which boasts significantly larger revenue, market cap, and higher-value enterprise clients. HubSpot's focus on the SMB (small & medium business) market and reliance on acquisitions for growth are diminishing the future return on investment and profitability potential for the company.

Ultimately, I rate the company a "hold" as it has downside protection as a potential acquisition target from Salesforce competitors.

A possible reversal tailwind to keep track of is a rejuvenation of the SMB economy that was severely pressured in the last few years.