How GTA 6 Impacts The Valuation For Take Two Interactive

More Than Entertainment: Understanding The Difference Between Good-Enough And A Blockbuster In Gaming

Repeating success in gaming is the largest production challenge. Understanding what drives games beyond entertainment value is a key indicator.

The gaming industry has left a demand vacuum, making it ideal for GTA 6 to step in.

GTA 6 could significantly boost Take-Two Interactive's revenue, but the game's quality and reception are not a given.

Despite potential short-term gains, TTWO's high valuation and unpredictable future revenues make it suitable for traders, not long-term investors.

Scenario analysis indicates the market expects over 70M GTA 6 copies sold, with an average $100 spend per customer in the first year.

- - - End of excerpt - - -

Summary: GTA 6 impact on TTWO 0.00%↑ valuation

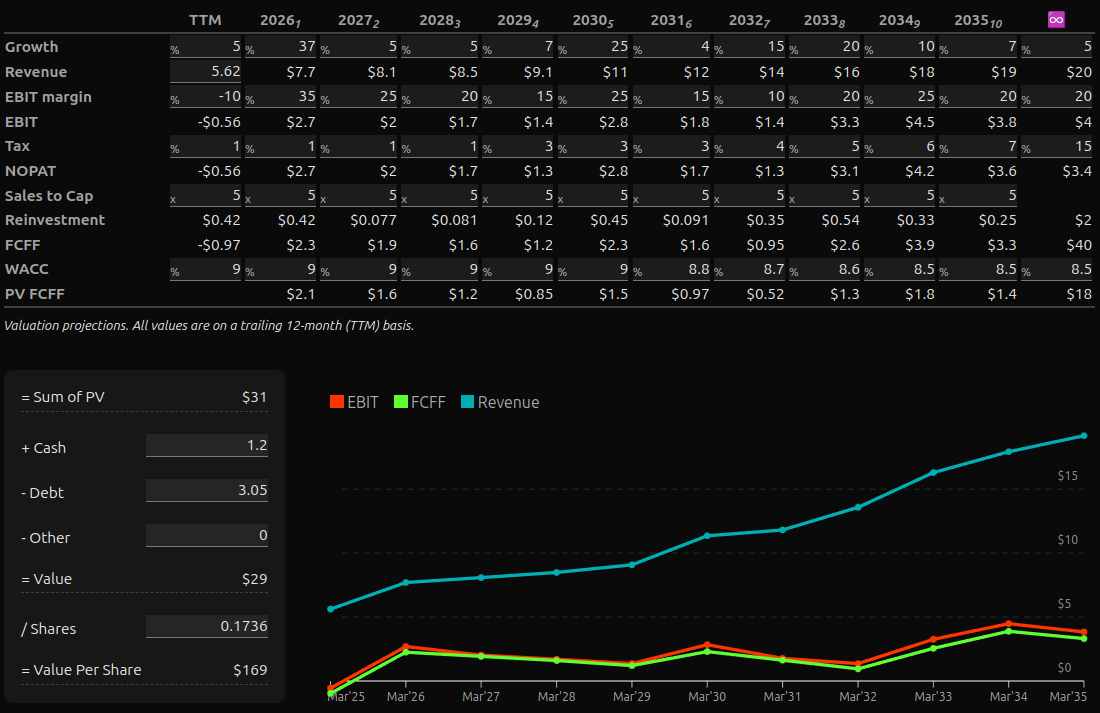

Base case:

Value $170 per share / $31B

GTA 6 sales to contribute $2.8B from a total of $7.7B revenues 12-months after launch

Est 80M copies sold for an average of $80

GTA 6 comes out as pretty good, fills void left by other companies

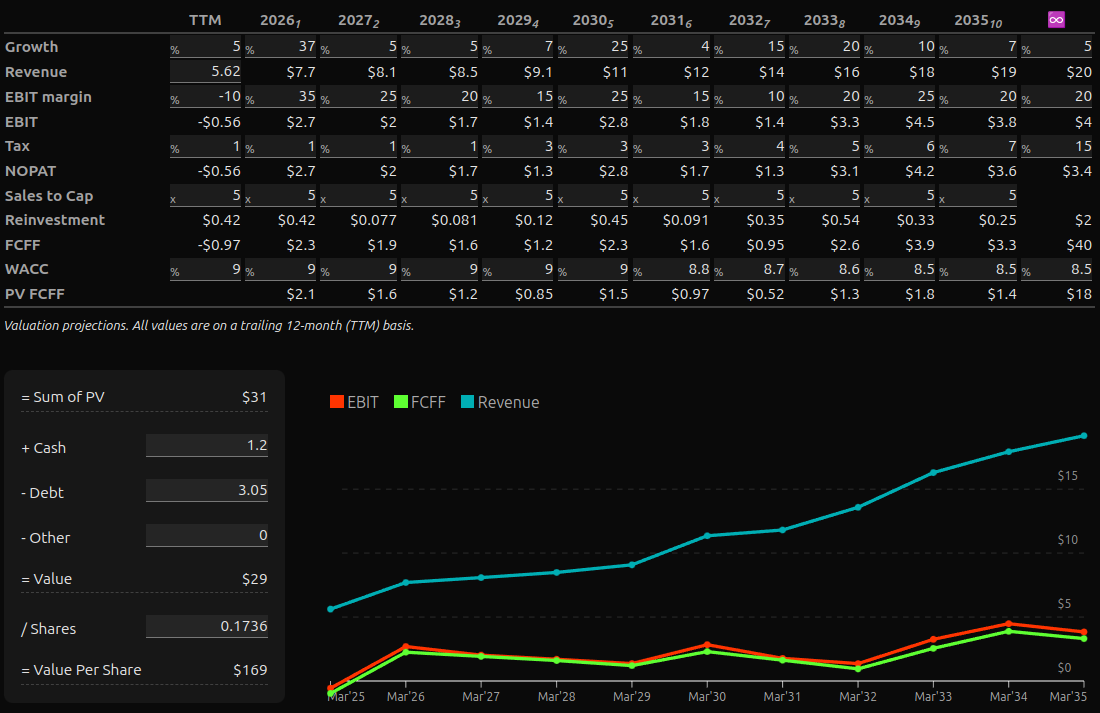

Bull (market implied) case:

Est 70M copies sold at an avg. of $100.

Total revenue above $12B.

Around $6B operating income

Value $222 per share / $40B

Besides the financial valuation, I elaborate on what is the core value of gaming, and how well positioned is TTWO 0.00%↑ to capture the expectations for one of the most popular titles in gaming.