Austrian Stocks: Wienerberger AG

An undervalued building materials' stock in a developed niche market.

By holding domestic stocks, investors may be overly exposed to the risks of their home market. This home bias, persists from the days when international trading was limited and available to professional investors. However, the current landscape makes it easy for investors to diversify across geographies, which can help with risk mitigation.

Until recently, the most popular international region was China, but investors were faced with a changing political climate that depressed Chinese stocks, and chased them away. This, and the turbulence in Europe, created the appearance of a global pullback, while it is evident that some markets may have more potential to rebound than others.

That’s why, we need to take a second look at international stocks, and examine their potential in frequently overlooked markets like Austria.

The Austrian Equity Market

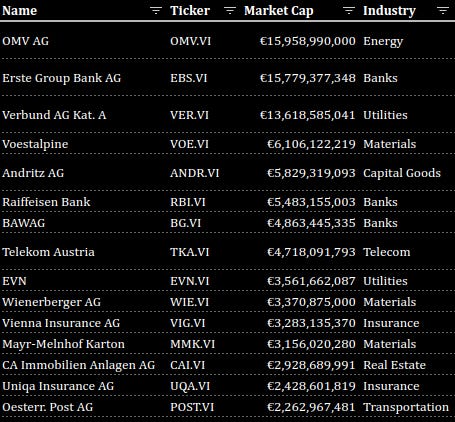

The 15 largest stocks in Austria have a combined market cap of €93 billion, which is a relatively small market, but may be an overlooked niche that investors can take advantage of for this reason.

The number of companies, with a market cap above €300 million, is 28 and their combined market cap is €107 billion.

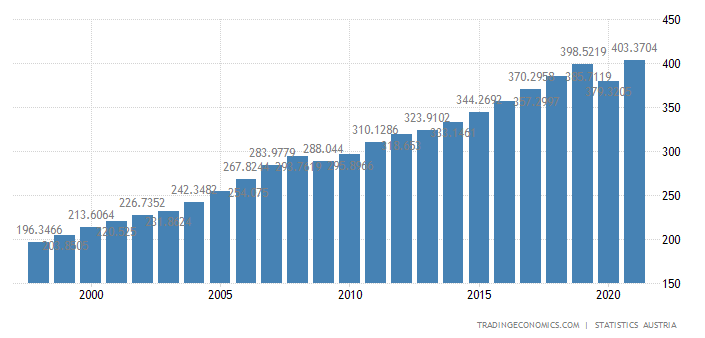

However, despite the small number of companies, Austria has a stable and growing economy with a gross national product (GDP + income from abroad) around €403 billion.

In order to put this into context, we will compare the Austrian market cap to its GNP, versus the US. We find that the Austrian market cap to GNP is 0.33x:

(The market cap to GNP for Austria is €133.1 b / €403b = 0.33xCompared to the 1.7x in the US:

(US market cap 44,500 b) / (GNP 25,868 b) = 1.7xKey Takeaway

The ratio of market cap to GNP, means that the Austrian market is less capitalized compared to the US, which could be a good starting point for an assessment of its equity potential.

Next, we are going to evaluate Wienerberger as our first candidate in the Austrian market.

Wienerberger AG (WIE.VI)

Wienerberger is a leading manufacturer and supplier of building materials, primarily focusing on the production of clay bricks, roof tiles, and pavers. The company operates in 29 countries with more than 216 production sites.

The company’s business model is based on an integrated approach to production and distribution, with the company controlling the entire production chain from extracting the raw materials to the delivery of the finished product to the customer.

Overall, the company has a pretty solid business model with a diversified offering in the construction and materials industry.

The company faces two larger risk factors. One, is the decline of consumer demand, as evident by management’s expectation of a decline in 2023:

The other is the fluctuation in raw material prices, which are impacted by the economic growth of developing economies and their purchasing power. For this reason, we expect prices to normalize and start trending upwards again.

Fundamentals

As the company is involved in the construction industry, starting in 2021 it saw an-inflation mediated boost in sales. However, with the current global measures to curb inflation, real-estate projects have become more costly and revenues may start normalizing in the future. A counterweight to this is diligent raw procurement management, and focusing on cutting edge practices that ensure a continuous flow of projects.

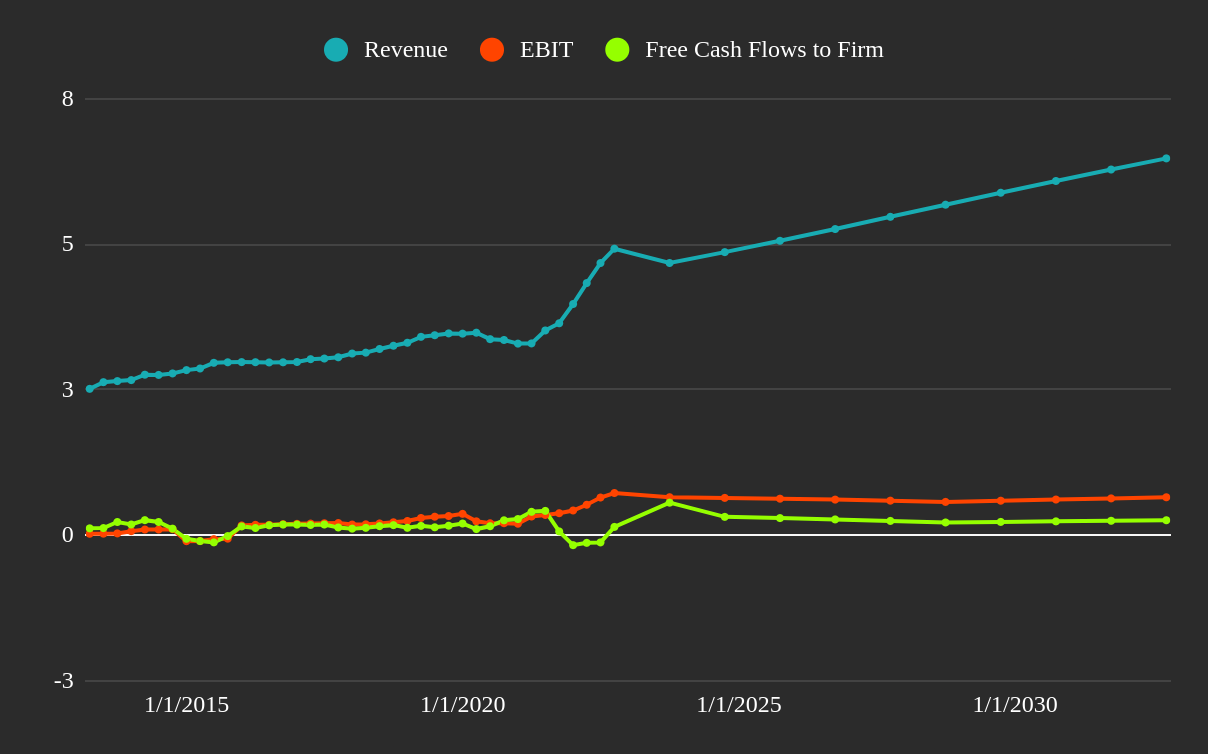

In the chart below, we can see Wienerberger’s historical fundamentals (on the left side), and our estimates of the company’s future capacity (right half).

You can copy our model and tweak it to match your expectations.

We can see that the company was steadily moving to €4 billion, up to 2020, when the pandemic and the crisis changed market dynamics. While a decline in revenues is expected, we estimate that the company’s impact will be lesser than anticipated by management. This is partly influenced by the diversification of their product portfolio, as well as an expectation of a stronger economy.

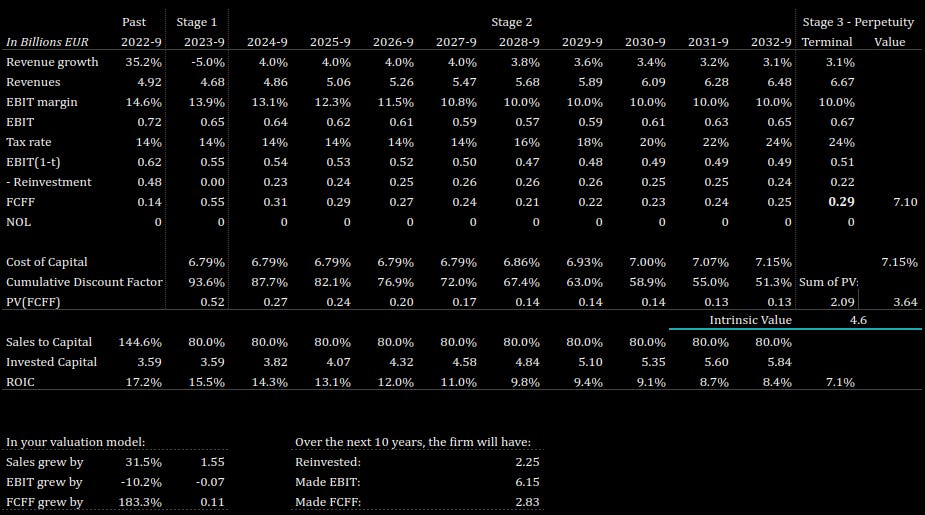

Valuation

Given our future projections, and a cost of capital of 7%, we derive an intrinsic value of €4.6 billion or €42.6 per share, implying that the stock is some 33% undervalued.

In conclusion, Wienerberger is currently amidst an economic down-cycle, which has the effect of depressing the stock. Investors may decide to evaluate if the company has the capacity to outgrow the downturn and keep a substantial portion of free cash flows in the future.

For these reasons, our analysis indicates that Wienerberger may be undervalued by some 33%.

Investors should note that the main risk is the potential persistence of a downturn, and an erosion of free cash flows from inflation. Should this happen, we expect that management cuts CapEx, and focuses on investing in selective and high return investments.