Apple Inc., valued at $2.3t or $143 per share.

In this brief, we will discuss why and how I came up with the $2.3t value.

In order to arrive at this estimate, we will analyze drivers such as revenue growth, estimated free cash flows based on margins, returns and risk distribution.

The following model, presents how the company should perform, in order to justify the estimated value.

If you disagree with any part in my model, drop me a comment and I will change the model to reflect your assumptions!

Usually, a model is valid for about a quarter, however for the fast-changing landscape that we are currently in, I wouldn’t be surprised if this model becomes invalid sooner.

Growth

Apple has the capacity and is competent enough to not allow less than 10% (CAGR) annual revenue growth.

As I am preparing the valuation today, talks of recession are frequent but uncertain - just keep this in mind as something that may seem to be obvious to people in hindsight.

In the last earnings call, management only remarked of a possible $8b hit to revenues because of supply constraints, so this has no major impact on the final model.

You can see that while I do assume a 10% in revenue growth, close to half of it is due to inflation, which makes me confident that the company can double sales in 10 years, reaching about $800b.

The difference between a 10% CAGR and a 15% CAGR in the next 5 years is around $500b in year 10, and in this stage of maturity of the company, I think that this would be too optimistic for Apple. Which is why I opted for a 10% CAGR.

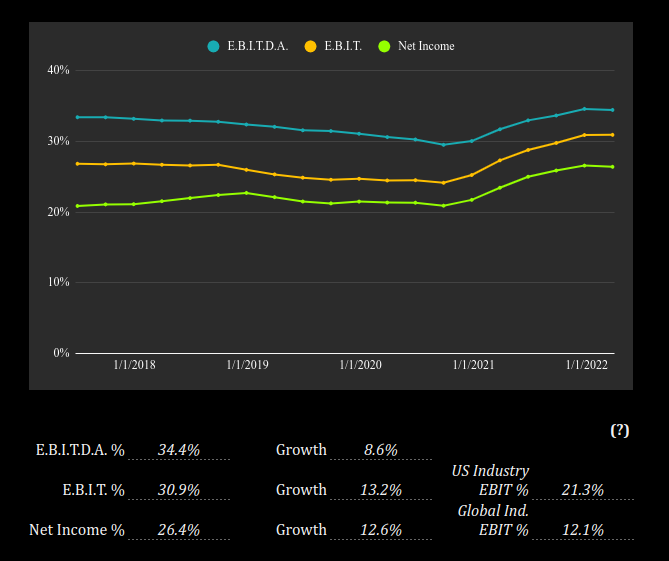

Margins

I do assume that Apple will become more profitable than it currently is at 30.9% EBIT margin.

Patents, software innovation, and economies of scale for devices make me comfortable envisioning a 35%+ EBIT margin in 10 years.

However, margins are also the biggest risk, as the political climate in the next decade may be increasingly hostile to public companies, and de-globalization winds may hurt the business.

Returns

The massive built-up infrastructure, market leadership position, and constantly being on the cutting edge-of innovation with a focus on the consumer, allow Apple to continue delivering high returns on invested capital.

Because of the value in their products, people don’t mind paying extra for additional features as it has the double benefit of giving them a streamlined experience, as well as a status symbol.

This gives Apple excess returns of about 94%, which is remarkably high.

The way we bring this into our valuation, is by lowering the amount of funds the company needs to reinvest in the terminal year, as it seems to have lasting advantages that keep delivering higher returns.

For this reason, I opted to increase the return on capital in the terminal year by 3% above the cost of capital, and I think Apple is one of the rare exceptions that can justify this.

Constructing Risk

In order to construct our cost of capital, we need to know where Apple gets its revenues by geography and by product.

The business risk helps us construct a bottom up beta, which is the weighted average of the exposure of AAPL to different industries, plus the risk of debt.

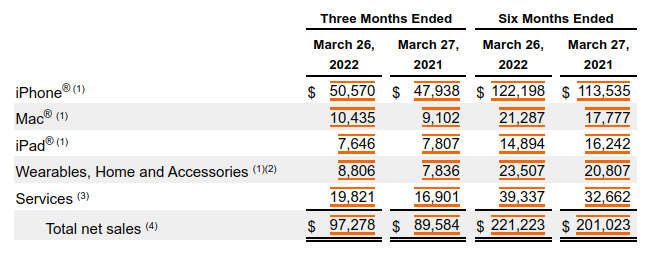

We can see in the table below, that most of the sales for Apple are coming from device sales, so we attribute an 82% exposure to the computers/peripherals industry. The remaining 17% is for services or the software industry.

Considering geographies, we see that Apple is an international company, with most of its revenues exposed to the US market. We account for this geo-distribution when constructing our enterprise risk premium.

The company is 5% debt and 95% equity funded, giving us a weighted average cost of capital of 9.4%

This is a rather high number, and is mostly due to the fact that both the riskfree rate and the demanded return from marginal investors for stocks has been increasing.

Just two months ago, this valuation would have had a cost of capital at around 7.5%, but we are not living in that world anymore.

Thank you for reading!

Feel free to go over the full workbook in the link below: